Active & Modified Atmospheric Packaging Market Set to Soar by 2034 — Strong Growth in APAC, Europe, USA and Saudi Arabia

Global active & modified atmospheric packaging market to grow from US$26.8B in 2024 to US$47.1B by 2034, driven by freshness, sustainability & tech innovation.

NEWARK, DE, UNITED STATES, November 12, 2025 /EINPresswire.com/ -- A sweeping transformation in packaging technology is driving exponential growth in the global active and modified atmospheric packaging (AMAP) industry. According to the latest analysis from Future Market Insights, the AMAP sector is projected to grow from approximately US $26.8 billion in 2024 to reach US $47.1 billion by 2034, representing a robust compound annual growth rate (CAGR) of 5.8% over the decade.

This surge underscores a broader paradigm shift, as food, beverage, pharmaceutical, fresh-produce and logistics industries increasingly demand packaging solutions that offer extended shelf life, enhanced safety and sustainable credentials.

Key Market Insights at a Glance

• The global AMAP market size is estimated at roughly US $26.8 billion in 2024, set to rise to about US $47.1 billion by 2034.

• Projected CAGR: ~5.8% from 2024–2034.

• The meat, poultry & seafood segment is a leading end-use, valued at around US $8.68 billion in 2024 and forecast to more than double to approximately US $16.34 billion by 2034.

• The polyethylene (PE) material type dominates, expected to reach revenue of about US $7.16 billion by 2034.

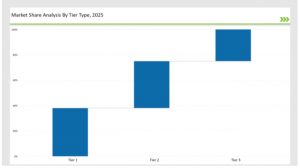

• Leading companies hold a concentrated share: top 3 players account for ~18% of market value in 2025; overall top tier holds ~38%.

To access the complete data tables and in-depth insights, request a sample report here: https://www.futuremarketinsights.com/reports/sample/rep-gb-21459

Regional Value & Dynamics

North America leads with strict food safety and regulatory frameworks, spurring adoption of advanced packaging technologies. For instance, the U.S. market was valued at approximately US $3.42 billion in 2024 and is projected to reach around US $6.32 billion by 2034. In the Asia-Pacific region, rapid urbanisation and rising demand for fresh produce underpin growth: East Asia alone is projected to reach roughly US $13.71 billion in 2034. Emerging economies such as India and Southeast Asian nations are expected to register above-average growth, driven by evolving retail, e-commerce and cold-chain infrastructure.

Segment Overview

• By End-Use Application: Food & beverage (notably meat, dairy, seafood), agriculture & fresh produce, pharmaceuticals & healthcare, e-commerce & logistics. The meat/poultry/seafood category remains the highest-value segment, supported by shelf-life extension and cost-savings in storage and distribution.

• By Material/Product Type: Polyethylene (PE) remains the largest material share due to its strength and flexibility; other materials such as polyvinyl chloride (PVC), polypropylene (PP), polyamide (PA), polyethylene terephthalate (PET), ethylene vinyl alcohol (EVOH), and ethylene vinyl acetate (EVA) increasingly feature.

• By Technology and Functionality: Oxygen scavengers & moisture absorbers; intelligent sensor-embedded packaging; biodegradable & compostable packaging; AI-optimised smart packaging.

Regional Overview

• North America: Focus on premium fresh and processed foods, stronger regulation, high adoption of advanced MAP/active packaging technologies.

• Europe: Similar dynamics to North America, strong emphasis on sustainability, circular economy packaging mandates.

• Asia-Pacific: Rapid urbanisation, growth in e-commerce logistics and fresh-produce trade create large opportunities. China alone is projected to grow at ~6.4% CAGR from 2024 to 2034.

• Latin America, Middle East & Africa (LAMEA): Slower adoption but strong long-term opportunity as cold-chain and retail infrastructure mature.

Competitive Landscape

The global AMAP market is moderately concentrated. The top 3 players – including major companies such as Amcor Limited, Sealed Air Corporation and MULTIVAC Group – command around 18% of the market in 2025, while the broader top tier accounts for about 38%. Tier-2 players such as Berry Global, Winpak Ltd. and Coveris Holdings collectively hold approximately 37%, and regional niche players make up the remaining ~25%. This structure highlights significant room for mid-tier innovation and regional consolidation.

Market Outlook: Powering the Next Decade

The future of AMAP will be powered by smart packaging, sustainability and supply-chain optimisation. Demand drivers include:

• Rising consumer expectations for freshness, minimal waste and convenience.

• Retailers and food brands seeking to reduce spoilage and returns.

• Regulatory pressure and sustainability targets prompting bio-based, recyclable and compostable materials.

• Technological leap: intelligent sensors, blockchain traceability, AI-driven production optimisation.

• E-commerce and cross-border cold-chain logistics expanding the geographic footprint of perishable goods.

With these tailwinds, the AMAP sector is set to become a foundational layer of global food & logistics infrastructure, underpinning supply-chain resiliency and sustainability for the next decade.

Key Players of the Sustainable Label Industry

Prominent companies making major strides include:

• Amcor Limited – introducing biodegradable, high-barrier flexible films.

• Sealed Air Corporation – launching intelligent freshness sensor-embedded packaging.

• MULTIVAC Group – scaling AI-driven MAP systems globally.

• Berry Global – rolling out 100% recyclable multilayer MAP solutions.

• Winpak Ltd. – strengthening oxygen-scavenging multilayer film technologies.

• Coveris Holdings – advancing fully compostable MAP films.

These firms are setting the standard for innovation and sustainability across the AMAP ecosystem.

Full Market Report Available for Delivery. For Purchase or Customization, Please Request Here: https://www.futuremarketinsights.com/checkout/21459

Recent Strategic Developments

Recent highlights include:

• Amcor’s award‐winning biodegradable high‐barrier packaging launch (March 2024).

• Sealed Air’s rollout of smart freshness indicators (April 2024).

• MULTIVAC’s expansion of AI-powered MAP solutions (May 2024).

• Berry Global’s commercialisation of 100% recyclable MAP packaging (June 2024).

• Winpak’s development of advanced oxygen-absorbing packaging (July 2024).

• Coveris’s venturing into compostable MAP films (August 2024).

These strategic moves reflect the industry’s shift from basic barrier films to full‐fledged smart, traceable and eco-certified packaging solutions.

Explore More Related Studies Published by FMI Research:

APET Film Market https://www.futuremarketinsights.com/reports/apet-film-market

Feeder Container Market https://www.futuremarketinsights.com/reports/feeder-containers-market

Fiber Based Packaging Market https://www.futuremarketinsights.com/reports/fiber-based-packaging-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

rahul.singh@futuremarketinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.